With apologies to Shakespeare, some companies are born great, some achieve greatness, and some have greatness thrust upon them. By the same token companies that emerge stronger from the Covid-19 crisis will be those which, over the coming months, foster confidence in the management of their people, the quality of their products and the vision of their leadership teams. This crisis will see many companies reshaping their approach to the market and their relationship with key stakeholders. The data underlines the fact that those who pay heed to their band reputation over the long term will emerge stronger than their peers.

When market recovery does begin, companies will need to channel all their efforts to deploying resources and assets to critical effect. The unique nature of this crisis makes it hard to draw parallels with previous ones such as the financial crash of 2007-08. However, one thing that almost certainly holds true is that company brand reputations will again play a significant role in sorting the winners from the losers.

Then, as now, the scale of market fall was shocking. The aftermath of the collapse of Lehman Brothers in 2008 saw the S&P drop by -32%, compared to declines of -34% in reaction to the global pandemic. Although the underlying dynamics then were better understood than they are now and the road to recovery easier to see, there are lessons to be learned about the impact company reputation can have on the extent and speed of stock price recoveries.

The critical role of company reputations was apparent in the marked differences recorded in both the depth of the initial decline and the subsequent rate of recovery, between companies with measurably strong reputations versus those with low performing reputations.

The critical role of company reputations was apparent in the marked differences recorded in both the depth of the initial decline and the subsequent rate of recovery, between companies with measurably strong reputations versus those with low performing reputations. The pace and scale of the recovery from the Great Recession of the late 2000s is evident. Individual company performances notwithstanding, stock price gains were broadly steady and, three years after the crash, the S&P had regained much of the ground lost. While this offers some basic encouragement, the headline hides more compelling pointers as to the importance of a strong and suitably structured corporate reputations.

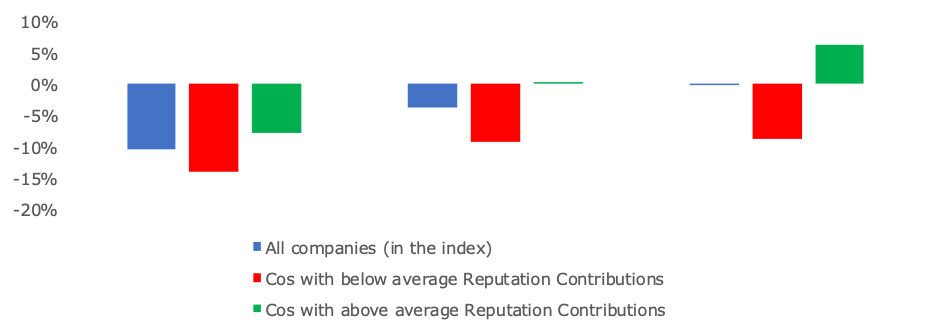

Two factors were found to have a major influence. First, the underlying ‘strength’ of a company’s reputation. A year after the demise of Lehman Brothers, market caps across the S&P 500 were down by an average of -10%. However, a closer look at the stock price performance of the 650+ companies tracked in our reputation study reveals that those with above average Reputation Contributions—the proportion of market cap attributable to reputation—saw market cap declines averaging just -8%, compared to declines of -14% seen by companies with below average performing reputations.

Two years later, three years after the crash, the market caps of those S&P 500s with high performing reputations had grown to the point where they were 6% above pre-crash levels; compared to declines of -7% for the companies with below average performing reputations. The slower road to recovery followed by the underperformers resulted in a gross market cap ‘shortfall’ of $293 billion, 2.4% of shareholder value in the index.

The second driver of recovery post 2008 was the make-up of companies’ reputations. Investor decision-making criteria shift as times and circumstances evolve and it was apparent by late 2011 that companies with high scores for long-term investment potential, people management and quality of products were creating more confidence and edging ahead of those rated for ‘lesser’ qualities. Brand reputation was driven by a range of factors, but the winners were the companies that best matched their reputation assets to prevailing investor interests.

The conclusions are clear. Strong corporate brand reputations not only helped to mitigate the impact of the 2008 recession but also to promote faster recoveries. This has significant implications for corporate leaders thinking about how best to deploy their own reputation assets and chart their company’s path as they emerge from this crisis.

Our partners at Reputation Dividend will be publishing their 2020 Report later in the year as soon as the ‘curves’ that many of us are focused on show signs of flattening and market volatility becomes more settled. The report will summarise the state of corporate reputation in both the US and the UK, identify the companies with the most impactful reputation assets and spell out the reputational factors of most interest to the investment community and to create value in a world coming to terms with COVID-19.

To pre-book an advance complimentary copy register here:

http://reputationdividend.com/fresh-thinking/reputation-dividend-advance-copy-request